The U.S. property/casualty industry took another underwriting loss in 2024, but results improved thanks to rate increases and changes in risk selection.

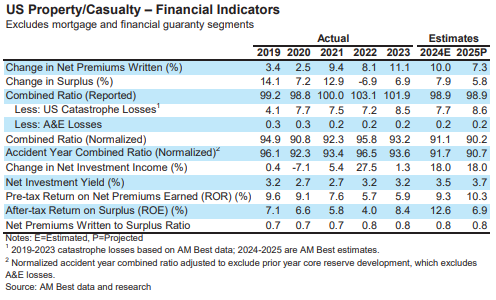

A report from industry rating agency AM Best this week said U.S. P/C insurers posted an underwriting loss of $2.6 billion in 2024 – a large improvement over the underwriting loss of $24.6 billion recorded in 2023. The estimated combined ratio for 2024 was 98.9 compared to 101.9 for 2023.

AM Best said it expects the industry in 2025 to “build on its solid rebound” with improved underwriting and operating results – even in the face of more losses from secondary perils and continued adverse litigation trends such as social inflation and third-party litigation funding.

The personal lines segment will be a driver of expected improvement, AM Best said. In 2024, personal lines posted a net underwriting loss of $11.9 billion compared to a loss of $36.7 billion in 2023. Rate increases in auto and home insurance, the combined ratio for auto was 98.7 (from 104.9 in 2023) and homeowners was 105.7 (from 110.9 in 2023).

AM Best said personal lines premium increased 12.9% in 2024, and is projecting to increase 9% this year. “Insurers are focusing on achieving the rate increases necessary to address their calculated rate needs, particularly for the lines of coverage such as private passenger auto and homeowners multiperil,” the agency said, adding that insurers are “prepared to withdraw from a given state entirely if needed increases are not approved.”

The homeowners segment is still expected to record a slight underwriting loss in 2025, according to AM Best, but the achievements in 2024 in personal auto – after three years of underwriting losses – should continue as the line has made strides to achieve rate adequacy while effectively using technology and data analysis.

“Because this line accounts for a third of all the P/C industry’s annual direct premium and more than a half of personal lines premium, its results – whether positive or negative – have a material impact on the P/C industry’s overall results,” AM Best said, predicting a further reduction in combined ratio in 2025 for private passenger auto to 97.5 from 98.7 in 2024.

Though commercial lines outperformed personal lines with a 2024 combined ratio of 97, it was no thanks to commercial auto, which turned in a combined ratio of 108.5. AM Best said it has a negative outlook for commercial auto, general liability, and D&O.

“AM Best estimates that commercial lines net premiums were up 6.1% in 2024, from 8.1% in 2023, reflecting continued price declines in workers’ compensation as well as certain specialty casualty lines,” the agency reported. For 2025, AM Best said it expects growth to weaken to about 4% but the combined ratio should remain steady at 97.

Topics USA Profit Loss Underwriting AM Best Market Property Casualty