It’s very early in the recovery process and already the numbers are large.

Insured losses for the tragic collapse of the Francis Scott Key Bridge in Baltimore could be as much as $2 billion to $4 billion, according to Morningstar.

S&P Global Ratings estimates $3 billion, which would still make this tragedy the largest marine insurance loss ever recorded.

Barclay’s analysts believe damage claims for the bridge alone could reach $1.2 billion, while claims for wrongful deaths and business interruptions could run $350 million to $700 million, according to Bloomberg.

“While the total cost of the bridge collapse and associated claims will not be clear for some time, it is likely to run into the billions of dollars,” said Matilde Jakobsen, senior director, analytics, AM Best.

These estimates track with what others are seeing and saying in terms of this tragedy being a major marine insurance event.

“I do see this claim as having a high likelihood of being one of the largest marine claims on record – rivaling Costa Concordia in 2012 or Exxon Valdez oil spill in 1989 — almost 35 years ago to the day,” John A. Miklus, president, American Institute of Marine Underwriters (AIMU), told Insurance Journal.

“While the incident still has to be investigated, we believe it has potential to become a significant insurance claim, particularly in the marine market,” wrote a Barclay’s analyst cited by Bloomberg.

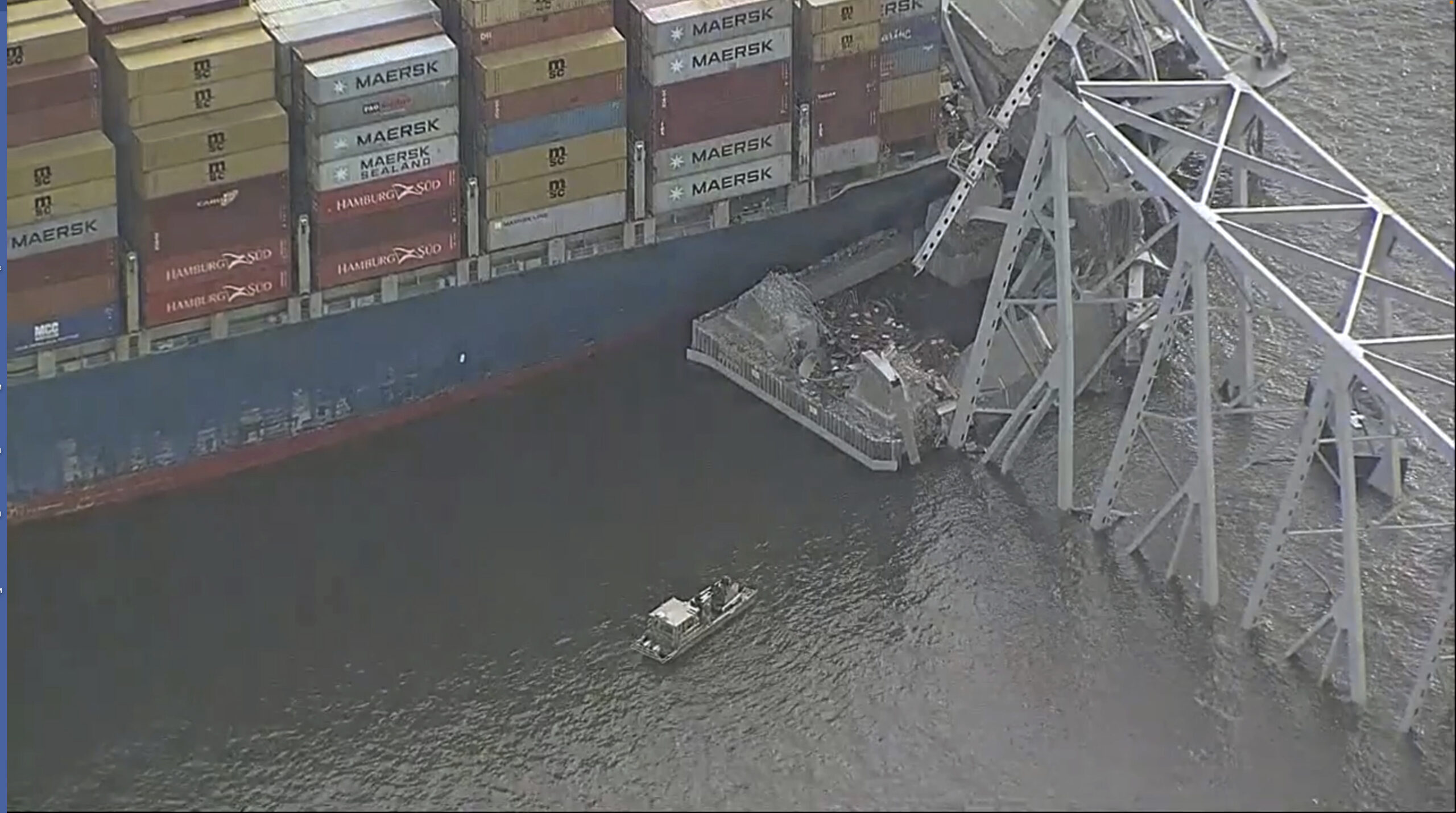

When the 985-foot-long Singapore-flagged vessel Dali struck one of the 1.6-mile bridge’s supports, the structure immediately collapsed into the water. Six construction workers are presumed dead after falling off the structure into the Patapsco River; two survived.

The Dali, which is owned by Grace Ocean and managed by Synergy Marine, was chartered by Maersk to ship cargo. It was carrying almost 5,000 containers on board at the time of the accident, according to Synergy Marine.

The early insured loss estimates dwarf those linked to the sinking of the cruise ship Costa Concordia in 2012, which generated insured losses of more than $1.5 billion, and the Exxon Valdez oil spill in 1989 where insurance paid at least $780 million of Exxon’s loss.

A very different type of disaster, Superstom Sandy, which affected several states, cost the global marine market between $2.5 billion and $3 billion, according to the International Union of Marine Insurance (IUMI).

Owner Liability

The insurers and reinsurers behind Grace Ocean and Synergy Marine are expected to pay out the bulk of the losses. Typically, the ship’s own hull and machinery (H&M) insurance policy would cover any damage the ship itself sustained, as well as salvage operations for the ship.

However, the owner and operator face potential claims not only for damage to the bridge and cargo but also for loss of lives and business.

“An extremely complicated loss such as this one is bound to result in a great deal of litigation but liability seems quite clearly to fall on the vessel and its owners,” AIMU’s Miklus stated.

Miklus explained that protection and indemnity (P&I) policies respond to all of the third party liabilities such as rebuilding the bridge, loss of income/revenue for the port and bridge authority, loss of life, injuries, salvage, removal of the bridge debris and more.

Joshua Gold, a leader of the marine insurance practice for the law firm Anderson Kill, agrees that given the navigational problems evident from the videos, the ship owner is likely to be scrutinized but adds that all parties probably will be targeted.

Gold also thinks there could be some infighting before all is said and done.

“It is likely that the insurance and reinsurance companies will be jockeying over ultimate responsibility for the losses. Given the early reports of engine / power issues when the crew signaled mayday, the charterer may allege the fault lies with the vessel and its owners. Conversely, the owner may try to lay the fault with the pilot/captain/crew,” Gold told Insurance Journal.

P&I Clubs

The P&I losses will be handled by a liability pooling arrangement that serves the global shipping industry. The 12 members of the International Group of Protection and Indemnity (P&I) Clubs collectively insure about 90% of the world’s ocean vessels. This group will play the biggest role in covering maritime liability risks, including third-party risks for damage cargo during transit. The reinsurance for this group of P&I clubs is likely to pick up the most.

One of the group’s members, the Britannia P&I Club, is the indemnity insurer for the Dali and responsible for up to $10 million in claims. Thereafter, the other 11 members of the P&I group will share most claims up to a total of $100 million. After that, up to $3.1 billion in general excess of loss (GXL) reinsurance is available. It is widely known that that AXA XL Insurance is the lead GXL provider for the International group of P&I clubs. Other major reinsurers are also involved.

AM Best’s Jakobsen believes the insurance issues related to the collapse of the bridge will take a “long time to unravel” and the total cost of the bridge collapse and associated claims is likely to run well above the $100 million attachment point for the GXL contract.

The same analysts projecting large loss numbers note that the insurance industry overall should be able to absorb the losses without too much trouble since the losses will be spread over various lines including marine liability and hull, property, cargo, trade credit, and business interruption. There could also be wrongful death suits by the families of the six workers who died.

Manageable Issues

Despite the challenges ahead, insurers should emerge without major issues, according to S&P Global, which titled its report, “Baltimore Bridge Accident Could Cost More Than $3 Billion And Only Dent Insurers’ Earnings.”

“We expect all the clubs and reinsurers involved to be able to manage their losses with no impact on ratings at this stage,” said S&P Global, noting that the maximum for all marine reinsurers would be $3 billion.

“Our view that the loss is manageable is further supported by the reinsurance sector’s strong underwriting performance in 2023. Favorable pricing suggests that underwriting performance will remain strong in 2024,” S&P Global added.

It helps that the marine line entered 2024 in good shape. According to a February 2024 segment report by AM Best, the 2022/23 period — prior to the challenges in the Red Sea— was the first year of combined underwriting profits for the 12 members of the International Group of P&I Clubs since 2016/17. The group reported an underwriting surplus of $152 million for the 2022/23 financial year, a significant improvement compared with the previous year deficit of $267 million. For 2023/24, AM Best said it expected underwriting performance to be in line with 2022/23, with most of the clubs likely to achieve around breakeven combined ratios.

However, there is still some worry about the marine line and especially reinsurers. Morningstar, S&P Global and AM Best noted that reinsurers will bear the bulk of the insured cost.

“The claim will likely involve several insurers, reinsurers, subrogation, and legal issues and will serve to add to the increasing challenges in reinsurance availability,” Jakobsen said.

“In our view, these losses will add to the woes of marine insurers who have been facing recent challenges due to the Houthi rebels’ attacks in the Red Sea,” said Marcos Alvarez, managing director, Morningstar. “We also anticipate that the losses linked to the collapse of the Baltimore bridge will add upward pressure to the pricing of marine insurance coverages globally.”

Limiting Liability

While the estimates of losses are running high, Anderson Kill attorney Gold told Insurance Journal he believes it is likely that the potentially culpable parties and their insurance companies will “explore the filing of limitation of liability lawsuits” to cap their exposure given the enormous cost of this “allision.” He uses the term allision which is the nautical term referring to when a vessel crashes or runs into another vessel that is stationary.

Along those lines, Bloomberg reported the losses could be less if Dali’s operator proceeds in the US under an 1851 law, which was cited by the Titanic’s owner in a Supreme Court case more than a century ago. According to Martin Davies, of Tulane University’s Maritime Law Center, the 1851 law could cap the ship owner’s liability at how much the vessel is worth after the crash, plus any earnings it collected from carrying the freight.

While its claims will most likely be subrogated to other insurance, the state of Maryland does have $350 million per occurrence property and business interruption coverage for its bridges and tunnels. The policy renewed in December with a $50 million deductible and 30-day wait period, according to a November presentation by Deb Sharpless, chief financial officer of the Maryland Transit Authority. That’s a higher deductible and longer waiting period than in past years but the state decided to take on more risk itself given rising values of the structures it insures and rising premiums.

An analysis by the North Carolina-based economic modeling software firm IMPLAN suggests rebuilding the bridge could cost about $600 million. A researcher at the Urban Institute told Reuters a rebuild could cost “several billion dollars.”

President Joe Biden vowed that the federal government would move to rush funds to pay for the cost of reconstructing the bridge, although the Administration also said it that the government expects insurance would ultimately pick up some of the tab. The White House did release $60 million in emergency funds to help jumpstart the recovery. Congress must approve additional funding.

Top Photo: Parts of the Francis Scott Key Bridge remain after a container ship collided with one of the bridge’s support Tuesday, March 26, 2024 in Baltimore. The major bridge in Baltimore snapped and collapsed after a container ship rammed into it early Tuesday, and several vehicles fell into the river below. Rescuers were searching for multiple people in the water. (WJLA via AP)

Topics Profit Loss Market