The Federal Reserve entered 2024 within spitting distance of its inflation goal. But that’s not quite close enough for policymakers.

The risk that inflation could remain stuck above their 2% target is guiding Fed officials’ preference to keep interest rates where they are for now, even as investors have clamored for cuts.

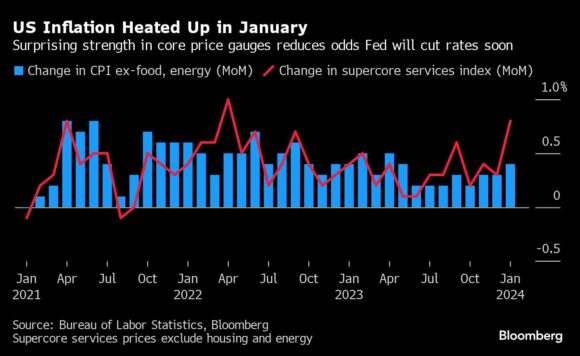

Fresh inflation data released Tuesday underscored their reason for caution: Consumer prices excluding food and energy rose more than expected in January, a sign that businesses still have the ability to raise prices, especially in the services sector. If officials were looking for more evidence that pricing power has been wrung out of the economy, they didn’t get it in Tuesday’s inflation report.

A slew of risks and uncertainty around their outlook — from a persistently strong economy to geopolitical tensions — are now weighing more heavily on their rate-cut timing decision and prompting them to approach it slowly.

“They want to get this right and they are willing to be late rather than even on time,” said Kathy Bostjancic, chief economist at Nationwide Mutual Insurance Co.

What’s giving them pause? Policymakers have outlined a few key risks:

Hot Economy

Fed officials’ economic forecasts released in December showed they were counting on slower growth — below a 2% pace in 2024 — to return inflation to target.

But they continue to be baffled by the economy’s momentum, which has continued in early 2024. Employers added 353,000 jobs in January, and a New York Fed Nowcast model estimates first-quarter annualized growth of 3.3%, the same pace as the fourth quarter.

With the economy so strong, lowering rates too soon could halt the progress made on inflation, and raise the odds that it settles in higher than the Fed’s goal, Chair Jerome Powell said in an interview with CBS’s 60 Minutes this month.

“We think we can be careful in approaching this decision, just because of the strength that we’re seeing in the economy,” Powell said about the timing of rate cuts this year.

Some officials on the policy-setting Federal Open Market Committee have suggested the economy might have changed since the pandemic in ways that make it more resilient to higher interest rates. That raises questions about how tight monetary policy is right now, given how brisk economic activity seems, Minneapolis Fed President Neel Kashkari has said.

“The implication of this is that, I believe, it gives the FOMC time to assess upcoming economic data before starting to lower the federal funds rate, with less risk that too-tight policy is going to derail the economic recovery,” Kashkari wrote in a recent essay.

Geopolitical Risk

Fed officials are increasingly pointing to tensions around the world — including wars in the Middle East and Ukraine and attacks on cargo ships in the Red Sea — as factors that could disrupt supply chains and rattle energy markets, upending their outlook for easing inflation this year.

“Uncertainty lurks in numerous corners,” Atlanta Fed President Raphael Bostic said last month, pointing to geopolitical risks as one reason “it would be unwise to lock in an emphatic approach to monetary policy.”

Spot freight rates from China to southern European ports have more than doubled since the end of last year, with some ships re-routing around southern Africa. A 40% rise in shipping rates would equate to about a 10-basis-point increase in year-over-year core inflation in the US, said Stephanie Roth, chief economist at Wolfe Research in New York.

While in the past companies might have absorbed the higher costs, businesses in the post-pandemic era may be more inclined to pass them along to customers again.

“Inflation is still elevated,” Roth said. “It is tough for central banks to entirely look through” price shocks now, she said.

Financial Conditions

Financial conditions eased markedly after Fed officials signaled they were done raising rates in December, and measures such as the Chicago Fed’s national financial conditions index show that overall financing costs are looser than average.

Several Fed officials, including Cleveland Fed President Loretta Mester and Governor Michelle Bowman, have warned that a continued easing could stoke demand and potentially fuel further inflation.

Powell seemed determined to keep those financial conditions in check by communicating the high bar for a first rate cut last month. At a press conference following the Fed’s Jan. 31 decision, he said the first move would be a “highly consequential decision.” He has also stood by the Fed policy committee’s projection for three rate cuts this year. Futures markets are pricing in a probability of about four.

“The last mile” on inflation back to the 2% target “is all about Fed communication,” said Torsten Slok, chief economist at Apollo Management. If policymakers decide too early to signal a rate cut, that could give “green lights for hiring and capital spending and make the last mile all that much harder.”

Photo: A pedestrian passes the Marriner S. Eccles Federal Reserve building in Washington, DC. Photographer: Nathan Howard/Bloomberg