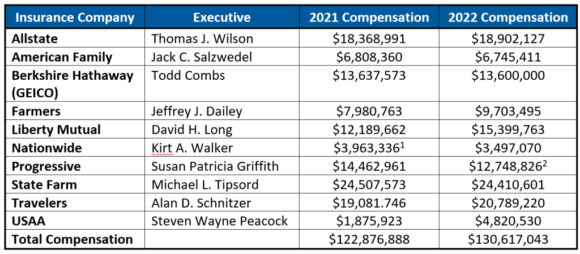

The research from the association of nonprofit consumer organizations found that CEOs of the top 10 U.S. personal lines insurers were paid more than $250 million in salaries, bonuses, and other payments combined in 2021 and 2022.

“CEOs are living high on the hog while increasing insurance premiums for people living paycheck to paycheck,” said Michael DeLong, CFA’s research and advocacy associate. “Insurers are telling regulators that ordinary consumers have to pay much more for auto and home insurance because the companies are struggling with inflation and climate change, but they are quietly handing CEOs gigantic bonuses.

Credit: Consumer Federation of America”Drivers are required to buy auto insurance and homeowners have to buy coverage to satisfy their loan requirements, so there needs to be more scrutiny of the rate hikes companies are demanding and the huge CEO paydays that are funded with customer premiums,” DeLong added.

Six CEOs received at least $12 million each in compensation in 2022 – led by State Farm CEO Michael Tipsord’s $24.4 million and the $20.8 million paid to Travelers CEO Alan D. Schnitzer.

Data was compiled from the Nebraska Department of Insurance, which requires insurance companies to disclose information about compensation to top officials, CFA said.

Note: CFA said 2021 compensation to of Nationwide’s Kirt Walker is inferred from filings with the California Department of Insurance in which the Nationwide discloses the compensation of its five highest paid executives. The highest paid executive from the filing is presumed to belong to Walker. Data on Progressive’s 2022 executive compensation come from its 10-K report to the Securities and Exchange Commission.

Related:

Topics Talent