Insurance broker Aon plc has developed a new insurance product designed for international transport and storage companies that are engaged in storing carbon dioxide for decarbonization projects across the globe.

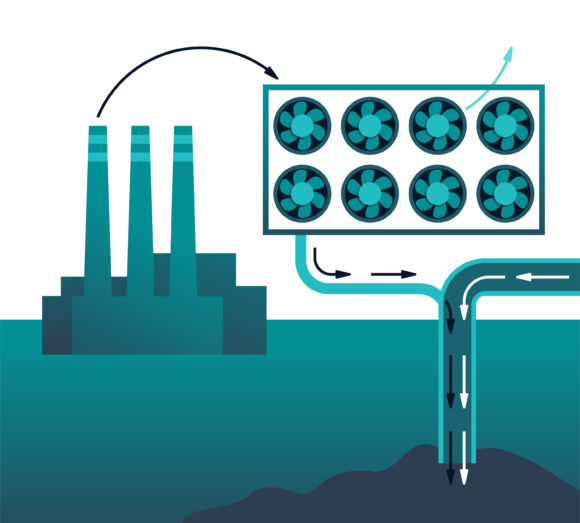

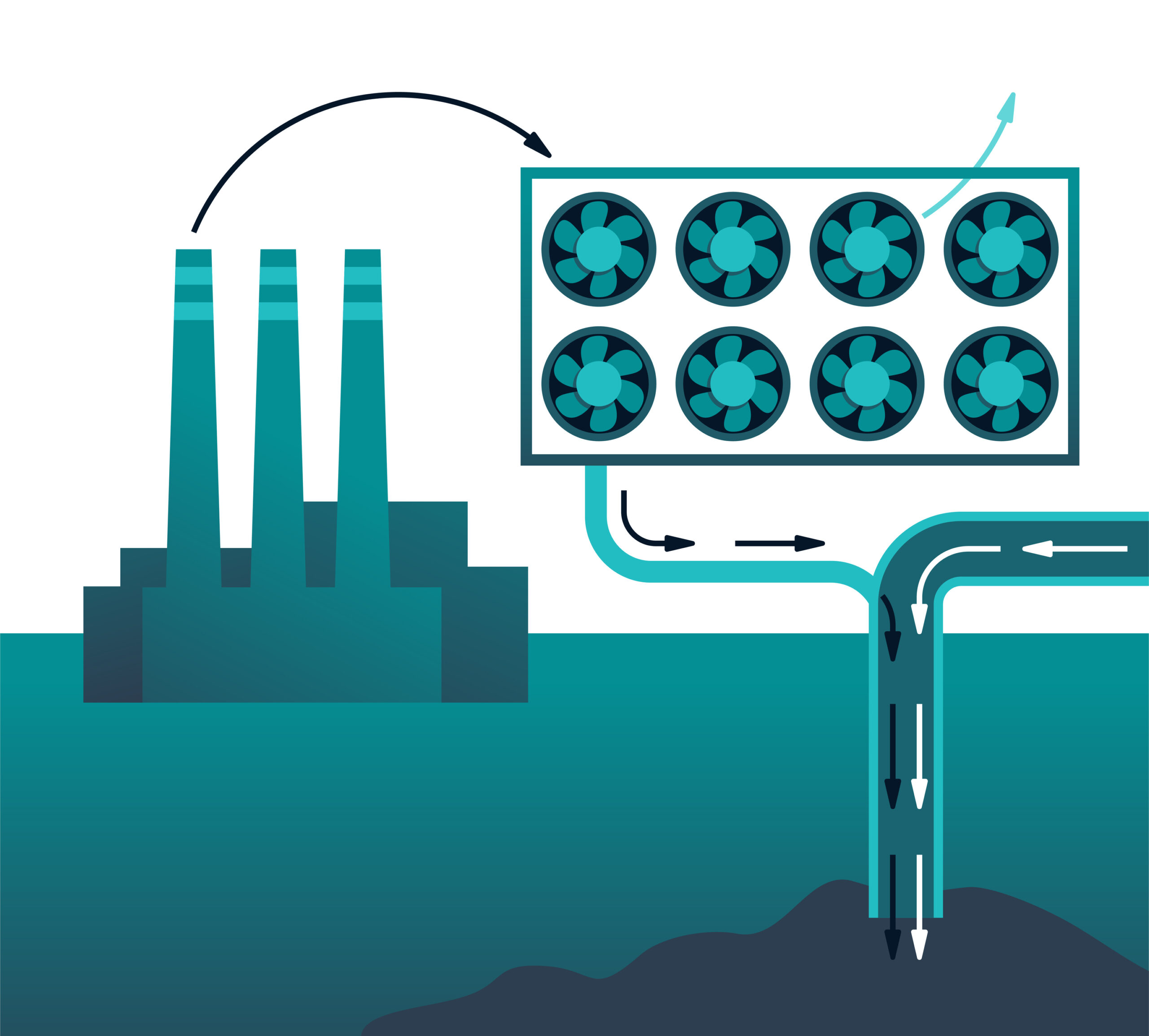

The new product is aimed at providing cover for key risk exposures associated with carbon capture and storage (CCS) and advances the role of insurance in de-risking global CCS projects, said Aon.

This, in turn, opens up access to capital providers and investors, addresses a significant protection gap for these developments, and changes the perception of what is insurable. Carbon capture utilization and storage addresses aspects of environmental, social, and governance (ESG) by reducing carbon emissions and allowing energy and other emitting industries to meet their net zero goals and objectives.

Aon’s energy transition product was created through its role as insurance broker to Eni UK, the lead company in the consortium delivering the low carbon and hydrogen HyNet North West project (in which Eni is the transportation and storage operator), and the Northern Endurance Partnership (NEP), comprising bp, Equinor, and TotalEnergies.

This project is among the first large commercial-scale and complete carbon transportation and sequestration processes for capturing, removing and storing industrial carbon dioxide emissions – which is key to the decarbonization of the UK’s industrial heartland.

The product has been developed acknowledging energy regulators and stakeholder expectations and in support of the assessment of available insurance coverage. While it was initially created in conjunction with a UK project, it has been designed to work for projects globally.

Aon’s multi-component CCS solution has the following key features:

- Sufficient capacity for physical risks, loss of revenue and general liabilities for large-scale projects;

- Newly created and bespoke coverage that responds to issues with storage reservoir integrity, including loss of revenue;

- Indemnity for loss of tax credits or requirements to purchase carbon credits associated with a leak of CO₂ from the carbon storage facility, and

- Placement with A- or higher-rated insurers, predominantly in the London market.

“Carbon capture is a fundamental component in reducing emissions and supporting the energy transition. While challenges remain, this is a first-of-its-kind risk transfer solution, aimed at providing comprehensive cover under an agreed policy wording, for transport and storage companies engaged in CCS,” commented William Lynch, business leader for natural resources at Aon, in a statement.

“Cover spans the construction and repurposing of existing assets as well as the operational phase. A huge benefit for operators and their investors, as well as their customers, is knowing what their insurance costs and coverage will be in an otherwise uncertain market,” Lynch said.

“Aon has spearheaded the development of this product over the last 18 months, working in collaboration with leading underwriters, and the legal community and we look forward to working on many similar projects,” he added.

Source: Aon

Topics Aon