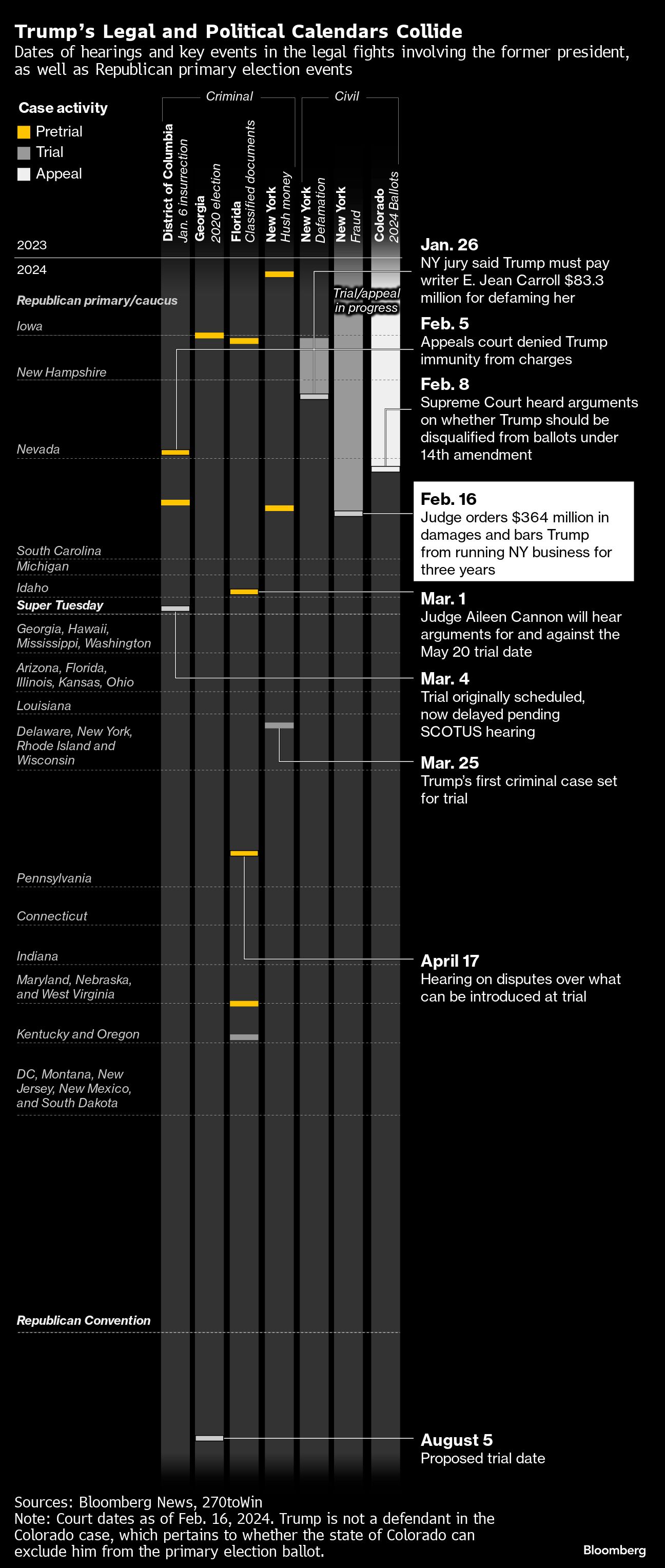

Trump Organization Hit With $365M Fine in Fraud Trial

The judge already held the former president liable for fraud ahead of the trial, and ordered the cancellation of his business certificates, putting at risk his future control of the sprawling real estate empire.

In his order Friday, the judge modified his September order, saying he would allow an independent compliance officer to renew the cancellation in consultation with the outside monitor “based on substantial evidence.” The order was temporarily put on hold in October by an appeals court while Trump challenged it.

More Details

Engoron also ordered that Barbara Jones, a former federal judge he appointed in 2022 to serve as an independent monitor overseeing Trump’s company, continue in her role for at least three more years and directed Jones to submit a report to him about “enhanced monitorship” over the company within 30 days.

The Trumps have already complained about Jones, rejecting her post-trial findings of continued financial discrepancies at the Trump Organization. The defense lawyers responded in a Jan. 29 letter to Engoron, disputing Jones’ findings and accusing her of trying to enrich herself by extending her appointment.

The monitor has already received more than $2.6 million in fees for her work, the Trumps said in the letter.

Engoron didn’t impose a lifetime ban preventing Trump from doing business in New York, as sought by the state. But the three-year ban on Trump’s participation as an officer in a business in the state industry is a symbolic blow for the former president, whose career blossomed in New York City.

He announced his candidacy for the presidency in 2015 after descending from an escalator in the lobby of his Manhattan headquarters. While Trump has moved to his Mar-a-Lago estate in Florida, New York City is still central to his persona.

Documents at the center of New York’s fraud case allegedly show Trump’s net wealth was inflated by as much as $3.6 billion a year from 2011 to 2021.

According to the state, values were boosted by counting luxury homes and other improvements that didn’t yet exist; appraising land as if there were no restrictions on development; and counting as cash proceeds that Trump didn’t have control over.

For years, Trump tripled the square footage of his Trump Tower penthouse apartment to claim it was worth more than $300 million, until Forbes magazine called him out.

This isn’t the first time Trump’s business interests have been stunted by the New York attorney general. In November 2016, then-President-elect Trump agreed to pay $25 million to settle the state’s civil fraud lawsuit against his Trump University, which had been accused of ripping off thousands of students.

Engoron oversaw the trial without a jury, hearing from dozens of witnesses and analyzing thousands of pages of evidence. Trump took the stand as a state witness, and spent his time under oath clashing with the judge and angrily denying that he’d done anything wrong. His sons also testified, downplaying any role they had in preparing their father’s financial statements.

Christopher Kise, the lead Trump lawyer at the trial, said in a statement that the fine was “draconian and unconstitutional” and called the verdict a “tyrannical abuse of power.”

“When a Court willingly allows a reckless government official to meddle in the lawful, private, and profitable affairs of any citizen based on political bias, America’s economic prosperity and way of life are at extreme risk of extinction,” Kise said.

(Credit: Bloomberg)

Copyright 2024 Bloomberg. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.