New Bill Requires IRS to Create Short Form for Taxpayers Living Abroad

What You Need to Know

- The simplified form would be similar to Form 1040-EZ as it existed in 2017.

- The bill would also expand the Foreign Earned Income Exclusion to include income earned overseas like pensions and distributions from retirement funds.

- Duplicative forms required by the Foreign Account Tax Compliance Act and the Bank Secrecy Act would also be eliminated.

New legislation, the Tax Simplification for Americans Abroad Act, would require the IRS to create a short-form certification for Americans living abroad who owe no U.S. tax and earn less than $400,000 annually.

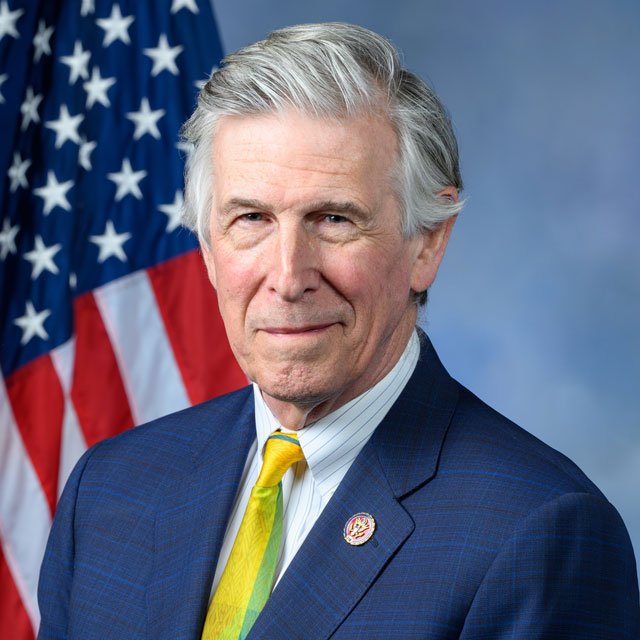

The bill, H.R. 5432, introduced Wednesday by Reps. Don Beyer, D-Va., and Dina Titus, D-Nev., would also expand the Foreign Earned Income Exclusion to include additional types of income earned overseas, such as pensions and distributions from retirement funds.

The legislation would also “consolidate duplicative and burdensome forms” that taxpayers must file under the Foreign Account Tax Compliance Act (FATCA) and the Bank Secrecy Act.

The simplified form, according to the bill, would be “similar to Form 1040-EZ as it existed in 2017.”

“Ordinary Americans living abroad are often overlooked when U.S. tax policy is written, which can make it extremely difficult and expensive for them to navigate the tax system,” Beyer said in a statement.

The bill, Beyer said, “would help ordinary Americans fulfill their obligations without having to retain an expensive accountant to certify that they owe no U.S. taxes, and remove some of the frustrations faced by Americans living abroad who just want to follow the law.”