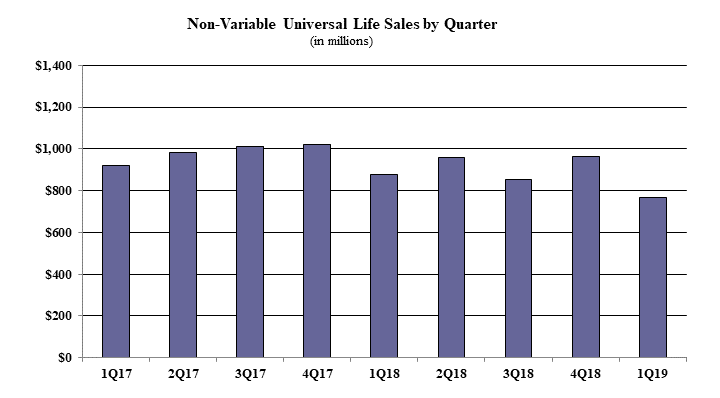

Non-variable universal life sales for the first quarter were over $768.2 million, down 20.4% when compared to the previous quarter and down nearly 13% as compared to the same period last year, according to Wink’s Sales & Market Report.

Non-variable universal life sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the first quarter included National Life Group taking over as the No. 1 company, overall, for non-variable universal life sales with a market share of 9.5%.

Pacific Life’s Pacific Discovery Xelerator IUL was the No. 1 selling product for non-variable universal life sales, for all channels combined, for the seventh consecutive quarter.

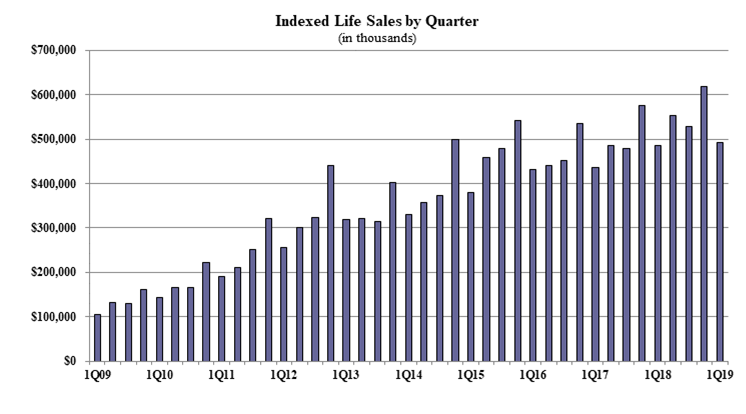

Indexed life sales for the first quarter were $491.7 million, down more than 20.3% when compared with the prior quarter, and up over 1.1% as compared to the same period last year.

“The 2017 CSO requirements are hitting everyone hard.” explained Sheryl J. Moore, president and CEO of both Moore Market Intelligence and Wink, Inc. “If companies’ sales aren’t down because their field force isn’t up-to-date on their reprice for the new mortality tables, they are down because they are too busy working on new products to focus on sales.”

Items of interest in the indexed life market included National Life Group moving into the No. 1 ranking in indexed life sales, with a 14.5% market share. Pacific Life Companies, Transamerica, Nationwide, and Allianz Life rounded-out the top five, respectively.

Pacific Life’s Pacific Discovery Xelerator IUL was the No. 1 selling indexed life insurance product, for all channels combined, for the seventh consecutive quarter. The top pricing objective for sales this quarter was Cash Accumulation, capturing 75.2% of sales.

The average indexed life target premium for the quarter was $8,900, a decline of more than 9% from the prior quarter.

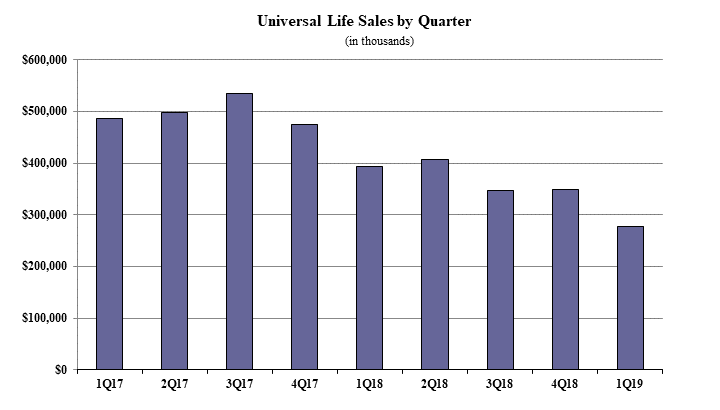

Fixed UL first-quarter sales were $277.4 million, down 20.5% when compared with the previous quarter and down more than 29.4% as compared to the same period last year.

Noteworthy highlights for fixed universal life in the first quarter included the top pricing objective of No Lapse Guarantee capturing 67.8% of sales.

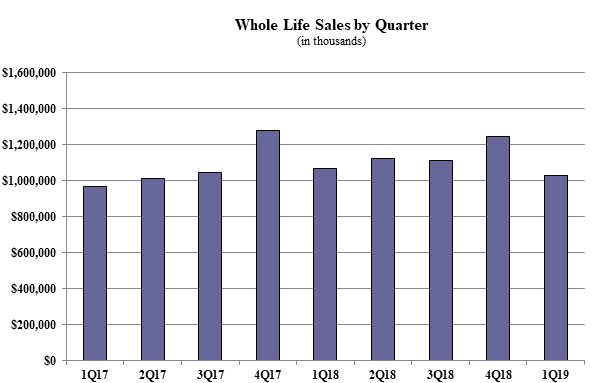

Whole life first-quarter sales were $1 billion; down more than 17.4% when compared with the prior quarter, and down 3.7% as compared to the same period last year.

Items of interest in the whole life market included the top pricing objective of Cash Accumulation capturing 67% of sales. The average premium per whole life policy for the quarter was $2,815, a decline of more than 24% from the prior quarter.

Wink is focusing on increasing participation with their current product lines of indexed universal life, traditional universal life, indexed whole life, and traditional whole life product sales, Moore said.

Additional product lines, such as term life insurance, will be added to Wink’s Sales & Market Report in upcoming quarters.