Re-opening the contentious life insurance illustrations model regulation is on the table, state insurance regulators said today, but the group is starting with a narrow look at issues with AG 49.

The National Association of Insurance Commissioners’ subgroup held an at-times contentious conference call to set an agenda for its work. Fred Anderson, acting deputy commissioner of insurance for Minnesota, put forth 23 options, separated into two groups: disclosure-related and beyond disclosure.

The list included re-opening the Life Insurance Illustrations Model Regulation, which would require approval from the NAIC A Committee. The original regulation was debated for years before gaining approval.

The regulators settled on accepting comments on these four options from the “beyond disclosure” list:

‘Juicing The Illustrations’

Actuarial Guideline 49 was developed in 2015 to provide insurance carriers a more uniform method for calculating maximum illustrated rates on IUL products and to help consumers better understand index life insurance product illustrations.

AG 49 states that: “If an insurer engages in a hedging program for index-based interest, the assumed earned interest rate underlying the disciplined current scale shall not exceed 145% of the annual net investment earnings rate.”

Insurers have since developed index performance multipliers and bonuses on IUL products in order to skirt this requirement, some regulators and consumer groups say.

Not everyone is in agreement on the supposed problem, which led to an extended back-and-forth between an industry attorney and Birny Birnbaum, executive director of the Center for Economic Justice.

“It’s still not clear to us exactly what problem we’re trying to solve here,” said Scott R. Harrison, who represents insurers such as Lincoln Financial and Pacific Life. “This sort of innovative business practice is normal and the kind of thing that we want to encourage in the industry.”

“Since AG 49, we’ve now seen products developed specifically for the purpose of juicing the illustrations,” Birnbaum shot back. “That’s not what I call being ‘innovative.’ That’s what I call ‘gaming the system.'”

The longtime consumer advocate called the situation “a crisis.” While a redo of the life insurance illustration regulation is welcomed, something more immediate needs to happen with AG 49, Birnbaum told Anderson.

“People are being sold products that are clearly misleading, clearly creating unrealistic expectations,” he said. “We’ve seen this happen again and again in this industry. Regulators have got to act quickly on this and there are some issues that can be addressed on a prompt basis with AG 49.”

That drew return fire from Harrison.

“We really take exception to Birny’s characterization of misleading conduct,” he said. “The illustrations are in fact accurately demonstrating how the products function.”

That brought Tomasz Serbinowski, actuary with the Utah Insurance Department, into the fray. He said Harrison was being “disingenuous.”

“The whole point and the whole issue is whether the values are realistic, it’s not that the companies want to show how the features work,” he said. “If that was the objective, we would have no problem.”

How To Comment

Following the meeting, the NAIC provided more information on the four options on which the subgroup is accepting comments:

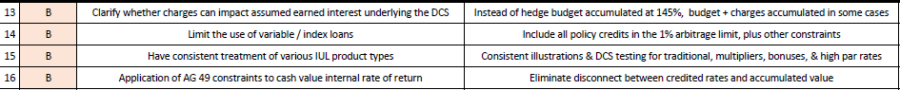

- Item #13 proposes to clarify AG 49 to ensure bonuses and multipliers are included as aspects of the disciplined current scale 145% test that are constrained.

- Item #14 proposes to generally limit the use of variable/index loans. For example, including all policy credits in the 100 bp limitation calculation specified in AG49, and not being allowed to illustrate at rates greater than fixed loan rates. Another potential aspect of this proposal is disallowing illustrating variable/index loans that are included as policy features, similar to the way certain index accounts are treated under AG49.

- Item #15 proposes to have consistent treatment of various IUL product types in terms of illustrations and disciplined current scale testing.

Current practice by some insurers is that bonuses and multipliers are applied after the AG 49 crediting rate and thus not subject to its limitations, whereas if the same implicit or explicit charges were used to fund higher cap rates and participation rates, they would be subject to AG 49’s limitations. - Item #16 proposes to apply AG 49 constraints to all factors leading to higher accumulated values and not just to the credited rate factor.

Comments can include concepts or proposed edits to AG 49 and should be provided to Fred Andersen ([email protected]) and Reggie Mazyck ([email protected]) by June 28.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2019 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.