How Susan Neely and ACLI are keeping the industry at the table during this crisis

This year has been the worst of all possible worlds for life insurance, an industry that depends on predictability.

Historically low interest rates are making it painful even to attempt projecting returns that will support products and sustain remotely attractive crediting rates. Meanwhile, the COVID-19 pandemic is hitting the primary age demographic that the industry serves, upsetting mortality tables. To top it all off, the face-to-face meetings that drive the industry’s sales are either banned or unwanted.

Pack all of that into a locked-down national capital filled with constant knock-down partisan battles and you have a good idea of what the American Council of Life Insurers is dealing with these days.

But ACLI has a seasoned pro as its president and chief executive officer, Susan Neely, who has been working in government and trade associations for nearly four decades. Neely was one of the architects of the Department of Homeland Security in the George W. Bush administration.

Although she started with ACLI just about two years ago, she had been involved with health insurance in the past as an executive with the Health Insurance Association of America for nearly a decade, leaving to help with the 9/11 response. While with the association, Neely led the “Harry and Louise” advertising campaign that so famously helped end President Bill Clinton’s effort to revamp health insurance in 1994.

The life insurance industry could not have asked for a more able defender than Neely in these times of historic challenges. In this conversation with Publisher Paul Feldman, Neely discusses the challenges the industry faces and the fights that still lay ahead.

FELDMAN: What does the ACLI see right now as the biggest challenge to the life insurance industry?

NEELY: Let me start in general first and then go into more specificity, particularly as COVID-19 has changed the trajectory of lots of things and increased some of the stressors on the industry.

Generally, one standpoint is our work with policy makers and regulators at the state and federal levels to make sure they understand the value proposition of this industry. There’s not the understanding there needs to be of how critical we are to individual Americans’ economic and financial security

This is the bedrock of our value proposition — the guarantees we provide people, those long-term promises — that’s our competitive differential with any other parts of the financial services industry.

We think there’s a great need for policy makers at all levels of government to understand that better. We are on a systematic and aggressive track to try to raise the understanding of that and partner closely with others to make that happen.

They should know things like we pay out $2.1 billion a day to individuals across our range of products, from life insurance for retirement and annuity payments to short- and long-term disability and long-term care. That’s a remarkable number — compare that to what Social Security pays out every day, $2.7 billion.

Somebody had said we’re like the wingman of Social Security, but I’d say we’re an essential part of the social safety net in this country, and that’s just not well understood. And it needs to be, particularly if you add to the COVID-19 context of the devastating impact the shutdown of the country has had on individual Americans’ financial security.

We were already on a campaign to make sure the policy makers understood that better, and we are even more so now. One-third of the small businesses in this country have life insurance, and that’s a source of emergency cash right now. That’s sustaining to them. Forty-seven percent of the private-sector workforce is covered by short-term disability policies.

Congress, as it looks to provide financial support to individuals to help them get through the pandemic crisis, doesn’t need to be disrupting the part that the private sector is already taking care of. That’s one big challenge in general, and it’s something we think about every day.

Then you get more specific: What are the challenges ahead? Low interest rates — we’ve been in a low interest-rate environment for the last decade. And that’s only become more acute because of the pandemic and the Fed moving rapidly to rescue the economy. Now we’re at virtually zero interest rates, which as you know has an impact on the credit spread. With these economic conditions, it makes it harder to maintain the affordability of products and still be there to make those long-term promises and guarantees that are back to what our value proposition is.

That is an ongoing concern, then related to that is the impact COVID-19 has had on fixed income investments. First and foremost, risk-free rates with U.S. Treasury rates are at historical lows.

The impact of those stressors are going to be around for a while. We’ve been working with LIMRA to help our shared membership understand the impact as they make business decisions, while also engaging with regulators around regulatory accommodations and changes that can limit some of the stressors they face. Those are things that are here to stay, and we’re going to be concerned about those.

FELDMAN: How has regulation been affected by the crisis?

NEELY: In these early stages, we have sought regulatory accommodations to allow companies to operate as essential services, and that’s led to important changes.

If you think about your readership, important changes are allowing business to continue to operate and write policies and pay benefits. E-signatures and e-notarizations are things that we’ve long wanted, and I think agents have long wanted because the consumer wants them.

Regulators are always conservative about erring on the side of what’s good for the consumer and protecting the consumer, as they should be. These kind of innovations — I don’t even know if you’d call them innovations anymore, they’ve been around a while — but these kinds of temporary accommodations have been really important to the industry, and we’d like to make those permanent.

With licensing, we had a whole group of producers in waiting who had finished all their classroom requirements and just needed to sit for the exam and complete the final steps. We went to bat, along with AALU and NAIFA and said, “Look, we need to try to accommodate this and have the ability to at least license these producers temporarily so they can get to work and earn a living and take care of their families.”

Now, some of those accommodations have proven to work fine. Those are some changes we seek to make permanent. Is there a way to license producers that doesn’t require a face-to-face as it did pre-pandemic? Those are some of the changes we see. We have a list of objectives that have been developed by ACLI and LIMRA and our shared members as part of a task force.

FELDMAN: How are the challenges different now from what happened after the 2008 crash? We also had the low-interest rate scenario then.

NEELY: I think what helped the companies navigate through the crisis in 2008, and will continue to help them, is that we are a cautious, conservative industry by nature. Our 30-year promises, 40-year promises, 50-year promises … it’s just baked into the industry’s DNA. We are very, very cautious about overextending.

We’re highly regulated at the state level, and that oversight ensures that we’re operating prudently and able to make good on those promises that we make to consumers.

We believe all of that will continue to be important to the industry’s success. But as I said earlier, we’ve gotten through the stressors with low interest rates and the collapse of Treasury bond yields that will add to the challenge going forward.

We also have the pandemic, which is different than the housing bubble. So, we’ve got CDC data that makes it clear that older Americans have been hit hardest by the pandemic. This is an unprecedented disruption to mortality data. It’s created some uncertainties and is going to make it difficult for life insurance to set premiums, at least in the near term.

That’s something that must be figured out as part of the business going forward. Certainly, we’ve heard the rumor that there’s a 40% to 50% increase in demand for life insurance, so it’s a great time for producers in the business. Underwriting, at least in the short term, is difficult until there’s better understanding of the pandemic and what it’s doing to age bands and mortality and morbidity rates.

FELDMAN: What do you see as some of the greatest challenges for distribution right now for carriers?

NEELY: I think the greatest challenges for distribution for the carriers is some of the things I mentioned, in terms of working virtually, as we’re all moving to either cancel face-to-face meetings and conferences or make them virtual.

I’ve heard people say over and over that we’re fundamentally a people business. We all go into it, whether you’re a producer or work in a company. Even at ACLI, we go into this business because we want to help people and we like to engage with people.

That’s an immediate challenge for distribution — the ability to meet with people face to face. We are doing our best to take care of some of the operational challenges. We’ve sought regulatory accommodations around electronic signatures, notarization and temporary producer licensing.

These are things that we’d like to see become permanent. That will be the lemonade out of the lemons, so to speak. Those can be pluses, but this difficulty of seeing people is a challenge to distribution and one I know that they are seeking to navigate. It is not an easy time for that.

FELDMAN: What would you like to see Congress do in this recovery in the life insurance and the retirement space?

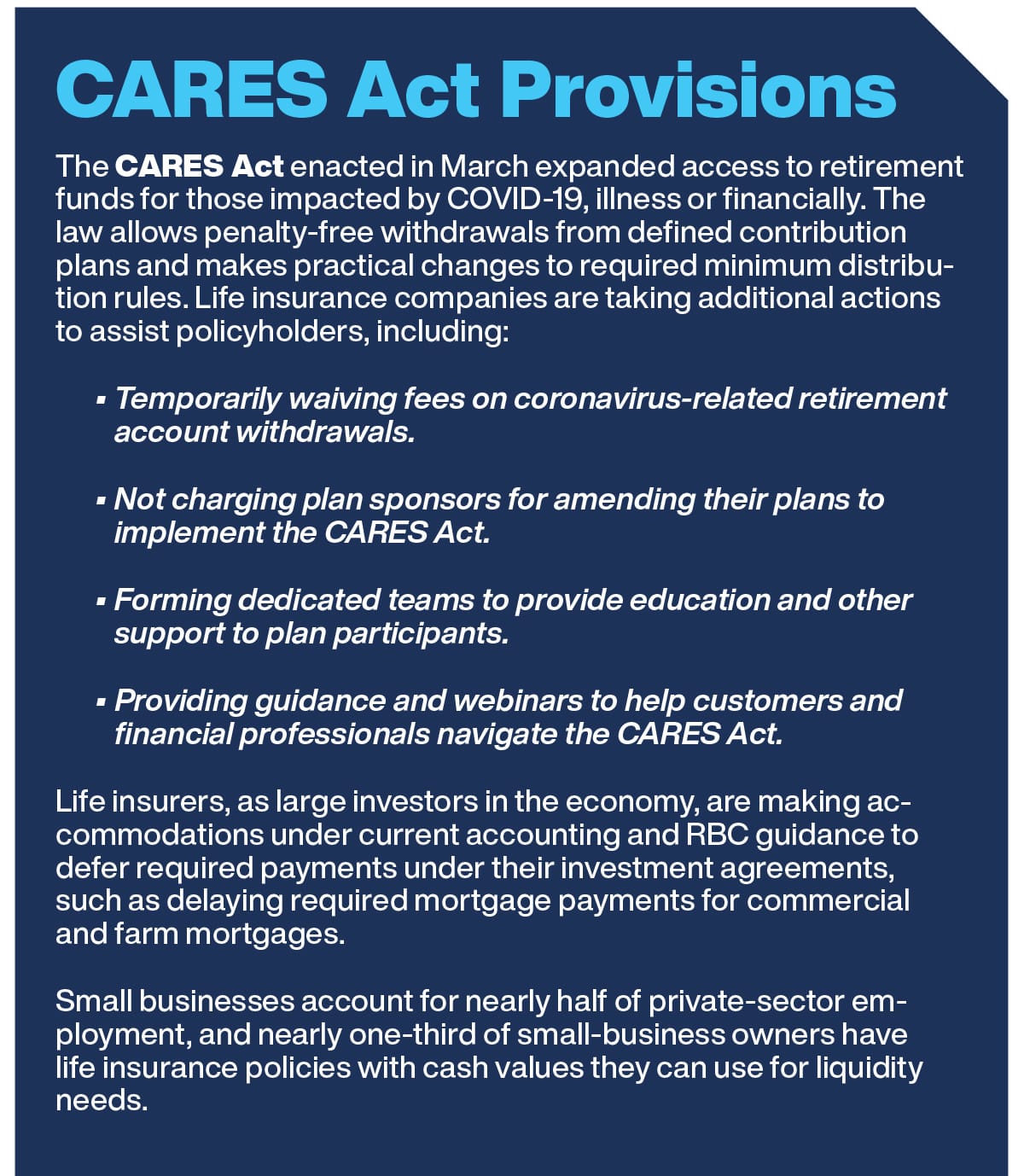

NEELY: In terms of Congress, there are immediate recovery packages or response packages. With the CARES Act, we were very engaged there on a couple of fronts and are actively engaged.

We’re going to host our first Zoom fundraiser for House Minority Leader, Kevin McCarthy (R-Calif.), so that will be interesting. The need for candidates and incumbents to raise money is not going away, so we’re going to do a fundraiser by Zoom.

We are actively talking to him and all members of leadership about what’s fairly certain to be another response package, and we have things that we think would be important to the industry to be included in that.

We’re very vigilant on paid medical leave so that it doesn’t become a platform for government encroachment of what the private market is doing so effectively through disability insurance.

We’re deep in those conversations, trying to be part of the solution. We know that people who don’t have any means of support need to be taken care of temporarily, but we don’t want to see the private market upended in that regard.

Back to the immediate concerns, if you look forward a little bit to where the policy debate’s going to go in this country, I guess we’d use the phrase that we “accelerated the inevitable.” We’re already deeply concerned about the retirement savings gap — people with inadequate retirement savings, aging of the population, and the fact that Social Security is a key part of the retirement social safety net.

Social Security will not have adequate funds by 2034, 2035. Plus, you have 60 million people in the gig economy who don’t have the ability to access workplace retirement savings. All of that was already a concern; it’s going to be even more of a concern going forward.

We are so thrilled that the SECURE Act passed Congress with strong help from the producers who were such valuable spokespeople before Congress. We’ll be working with them again around the opportunities to advance policies to help build the retirement savings gap.

Senators [Rob] Portman (R-Ohio) and [Ben] Cardin (D-Md.) are really some of the big thinkers. They have legislation that we have been supporting. There are elements of their legislation that we would like to see advance as it relates to improving the market for annuities, helping address student loan debts, that kind of thing. Retirement security will be a big area of focus going forward.

Paid family medical leave, that was already an issue gathering steam before COVID-19. Right now, it’s taken on a certain area of focus around protecting and supporting people who aren’t working. That debate around how we provide income replacement while people are taking care of family needs is only going to intensify going forward. Again, the private market has a big, big role to play. We want to make sure we’re part of that and able to advance solutions.

FELDMAN: What do you see on the annuity front that you’d like to move forward?

NEELY: In the Portman-Cardin proposal, we’ve got a provision that would modify the requirements to minimum distribution rules to support retirees who have partially annuitized their retirement savings. There’s another provision that would provide retirees greater flexibility to use longevity annuities to protect their income later in life.

Those are some of the things we are supporting, but there has always been a debate around what the required minimum distribution age should be for when you have to take your retirement savings.

We argue now, particularly as a result of the impact of the pandemic on people’s retirement savings, that if you are close to retirement, why not give somebody more time to not have to take a distribution on their retirement savings? Those are some of the things. Jill [Kozeny, ACLI vice president of public affairs], what would you add to that?

KOZENY: It really builds on SECURE and goes deep into the existing retirement system to turn up the dial to help people save more, help small businesses even more, expand plans for lower income Americans who don’t have coverage at all, and build in more flexibility for people who already are retired in terms of using their retirement savings dollars. It works within the existing retirement system and amps it up in every way possible, very astutely so.

Both Sen. Portman and Sen. Cardin are very, very committed to this issue. And so their bill reflects all of that deep knowledge and long-term thinking about how to enhance every policy possible to secure retirements for all kinds of Americans.