Insurance products remain solidly profitable, but big change is coming in who sells them and how they are sold, one leading industry analyst predicts.

More fee-based products, new channels and growth in direct-to-consumer sales are some trends Chip Roame expects in the coming years. Roame, managing partner of Tiburon Strategic Advisors, characterized insurance products as being in a natural transition phase.

“We still think the industry needs to consolidate quite a bit,” Roame said, adding that more products will be pushed out through other channels besides agents. “As these products are more widely available, I think that drives pricing, that drives competition, that drives profit … that drives a lot of things.”

Overall, insurance is about a $2 trillion industry, Roame said during a recent webinar. That is split between life/health ($1.2 trillion in 2019 premium) and P&C ($708 billion).

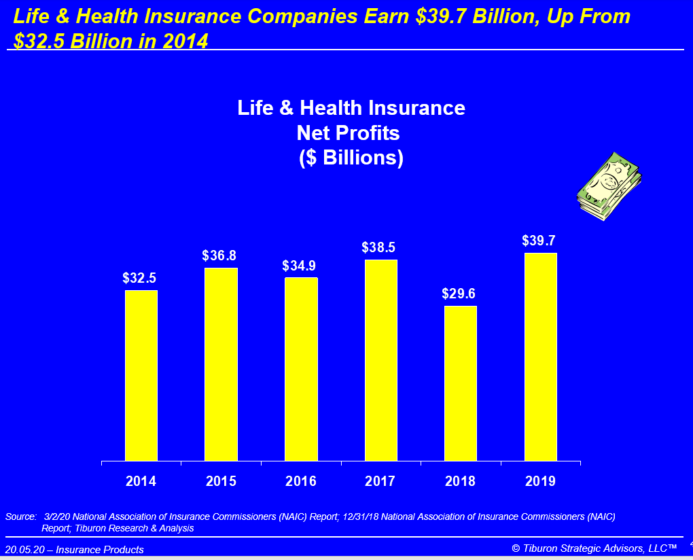

But the relationship is reversed when it comes to profits, Roame noted. P&C sales accounted for about 61% of the industry’s $102 billion profit.

MetLife remains the king of insurance, writing $103 billion in 2019 premium for about a 5% share of the market. State Farm followed with $66 billion in premium.

Roame shared several key points and predictions about the state of the insurance market, including:

- Long-term care insurance prospects dim. Long-term care insurance is “in a decline now as many of the carriers have pulled out,” Roame said. Carriers sold $479 billion worth of LTCi in 2019 premium, Tiburon reported, the lowest sales figures since 2010 and down from $600 billion in 2018.

Still, 71% of respondents at the Tiburon CEO Summit predicted “moderate growth” of LTCi over the next five years. Roame isn’t as confident.

“That may be wishful thinking,” he said. “I hope there’s some growth in the long-term care industry, but there aren’t a lot of players left in the space. There are some life insurance long-term care blended products that might get some traction.”

- Annuity assets under management remain in the $2 trillion range, Roame reported. But carriers reported $301 billion in 2019 premium, up 25% from 2017 sales ($241 billion). Variable sales are going down, Roame noted, while fixed and indexed annuities are selling very well.

Thirty-seven percent of Tiburon CEO Summit attendees expect annuity sales to “stagnate” over the next five years, up from 2 percent last year. About 50% expect “moderate” growth, down from 82% last year.

“I think they’re moderately pessimistic on annuities,” said Roame, adding that he would like to see the industry price the products better.

- Life insurance premium dropped from $181 billion in 2018 to $161 billion in 2019, while net profits dropped from $37.9 billion to $33.5 billion.

- Health insurance is booming. Health insurance premiums totaled $745 billion in 2019, another new high and up from $394 billion in 2010, the year the Affordable Care Act became law. Health care insurance net profits soared to $30 billion in 2019, up from a relatively minuscule $3.7 billion in 2015.

One hundred percent of CEO Summit attendees say advisors will play a role in helping clients with health insurance over the next five years, up from 60% one year earlier.

- More mergers and acquisitions. Roame predicted more M&A activity last year and was wrong. Insurance deals fell from 87 to 60.

“I’ll stick with my prediction that I think you’re going to see a lot of insurance company consolidation,” he said.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.