New annualized premium for voluntary insurance products totaled $7.2 billion in 2018, a 3% increase from 2017 sales results, according to LIMRA’s U.S. Worksite/Voluntary Sales Study.

LIMRA defines voluntary benefits as insurance products available at the workplace that are 100% funded by the employees. According to LIMRA research, since 2010 the percent of employers offering voluntary benefits as part of their overall employee benefits package has increased 11 percent.

“With five different generations in the workforce today, a one-size-fits-all approach to benefits is no longer a viable option,” said Anita Potter, assistant vice president and director Workplace Benefits Research, LIMRA. “Voluntary benefits provide employers with a solution that allows them to meet the increasingly diverse needs of their employees and their families.”

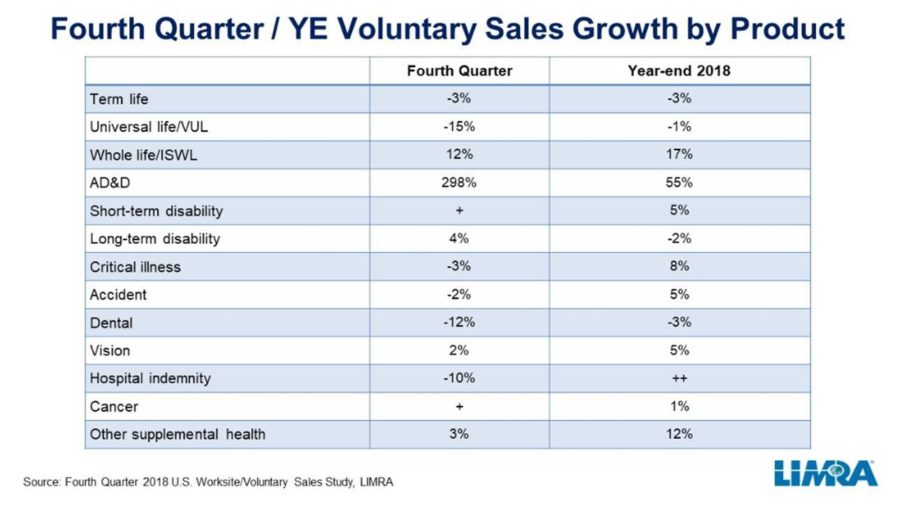

In the fourth quarter 2018, new voluntary life insurance premium jumped 8%, compared with prior year. For the year, voluntary life insurance products rose 3%, with substantial increases in accidental death & dismemberment and whole life product sales offsetting declines in voluntary term, UL and VUL sales.

New voluntary health insurance premium fell 3% in the fourth quarter but ended the year up 3%, compared with prior year results. For the year, growth in critical illness, accidental, short-term disability, vision and other supplemental health products drove the overall annual increase in voluntary health product sales.

“Critical illness continues to be a bright spot for sales, with an 8% increase over last year,” Potter noted. “However, growth of this product has been slowing from prior years, when we saw consistent double-digit gains. In contrast, voluntary whole life sales appear to be accelerating.”