U.S. Auto Insurance Rewards and Incentives Programs: Driving Forward

Now more than ever, auto insurance policyholders are tech-savvy and receptive to being first users of technology: Aite Group report

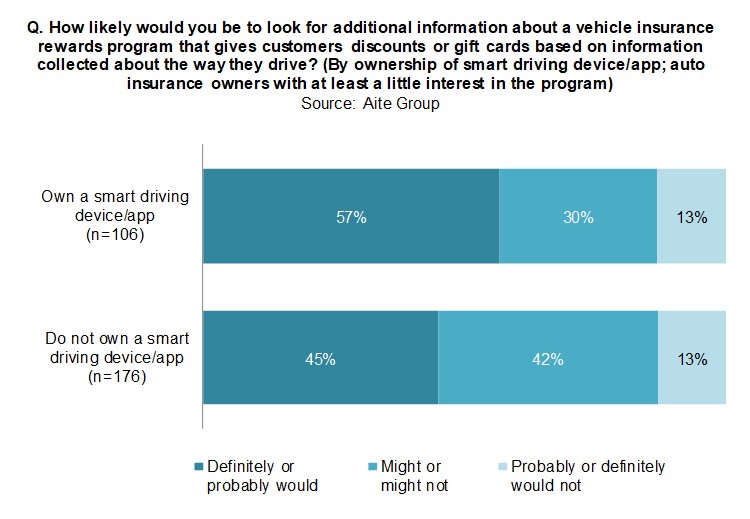

Boston, MA (Aug. 1, 2019) – Auto insurance carriers continue down the path of digital transformation, forcing them to examine new sources of data and how to integrate that data into their business. Auto insurance policyholders enjoy incentive programs, own auto-related connected devices, and are ready to share personal data in order to gain benefits. It is time for carriers to develop relevant connected-data-driven products as well as market rewards programs that are enticing and make sense, increase market share, and provide an endless source of real-time data. Aite Group’s new report, U.S. Auto Insurance Rewards and Incentives Programs: Driving Forward, explores the information necessary for carriers to design rewards and incentive-based products and programs fitting of the auto insurance industry.

“Consumers are already using connected devices and are willing to share data for a good reason, and carriers must be willing to offer a variety of options to fully realize the potential of this trend,” explains Greg Donaldson, senior analyst at Aite Group.

This report provides detailed statistics on auto insurance policyholders’ ownership and use of connected devices and their willingness to share this information with their insurance carrier. It puts a face on the type of customer that carriers should target and offers guidance on how to target these customers, and it puts a value on what customers expect in return for sharing their data. It is based on a Q1 2019 Aite Group online survey of 766 U.S. consumers.

Click here for the online report summary or to download the table of contents.

This report provides detailed statistics on auto insurance policyholders’ ownership and use of connected devices and their willingness to share this information with their insurance carrier. It puts a face on the type of customer that carriers should target and offers guidance on how to target these customers, and it puts a value on what customers expect in return for sharing their data. It is based on a Q1 2019 Aite Group online survey of 766 U.S. consumers.

This 55-page Impact Report contains 51 figures and two tables. Clients of Aite Group’s P&C Insurance service can download this report, the corresponding charts, and the Executive Impact Deck.

This report mentions Amazon, American Express, Apple, Beautyrest, Comerica Bank, Contour Next One, Dario, DiamondClean, Fitbit, Fitindex, Google, Green Dot, iHeart, Jawbone, Kolibree, Mastercard, MetaBank, Microsoft, MyFitnessPal, MyFoodDiary, Nest, NetSpend/TSYS, Nokia, Omron, OnStar, Oral-B, Philips, Polar, QardioArm, Renpho, Rhythm, Ring, RunKeeper, Samsung, Scosche, Snap, Tacx, The Bancorp Bank, Visa, Walmart, Weight Watchers, Welch Allyn, and Withings.

About Aite Group

Aite Group is a global research and advisory firm delivering comprehensive, actionable advice on business, technology, and regulatory issues and their impact on the financial services industry. With expertise in banking, payments, insurance, wealth management, and the capital markets, we guide financial institutions, technology providers, and consulting firms worldwide. We partner with our clients, revealing their blind spots and delivering insights to make their businesses smarter and stronger. Visit us at www.aitegroup.com.

Source: Aite Group

Tags: Aite Group, Amazon, Apple, FitBit, Google, incentives, Mastercard, Microsoft, SNAP Premium Finance, Telematics, Walmart Read the original article at Insurance-Canada.ca